How GoodHire’s Low Dispute Rate Benefits Employers

Accurate results delivered the first time means keeping qualified candidates in the pipeline, and peace of mind for you. Find out what GoodHire’s industry-leading low dispute rate means.

Jim Akin

11 min read

Click a chapter to scroll directly to it.

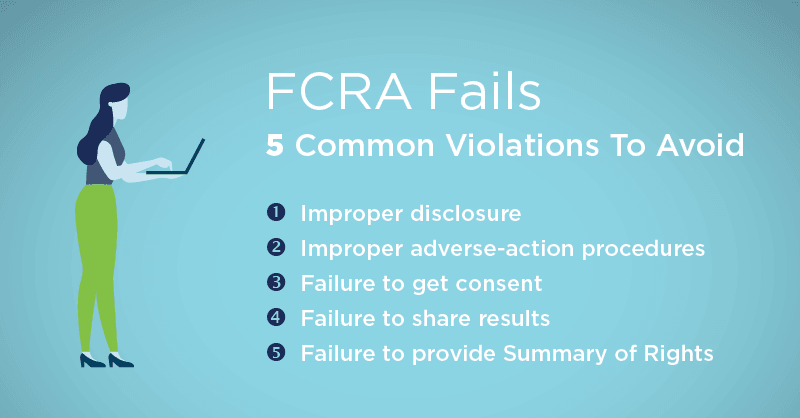

Do your company’s pre-employment background checks comply to the Fair Credit Reporting Act (FCRA)? Outsourcing to a reputable background screening provider can help ensure compliance with federal laws, but employers are ultimately responsible for meeting FCRA requirements such as sending pre-adverse action notices.

Learn how to avoid the most common FCRA background-check violations.

For employers, a chief benefit of outsourcing candidate background checks is letting professionals handle the bulk of responsibility for adherence to laws and regulations on collecting and reporting confidential information.

Professional organizations that perform FCRA-compliant background checks do most of the heavy lifting with respect to federal requirements, but employers still have some obligations under the set of regulations known as the FCRA, or the Fair Credit Reporting Act.

Employer failure to meet FCRA requirements can have costly consequences: Fair Credit Reporting Act violations are expensive to litigate and settle.

When Congress enacted FCRA in 1970, its intent was to protect the personal financial data compiled to create consumer credit reports. Congress has since expanded its scope significantly, and the types of companies governed by the FCRA, collectively known as consumer reporting agencies (CRAs), now include background-check services (such as GoodHire), as well as credit bureaus.

Among its provisions, the FCRA is intended to reassure consumers that:

Choosing a background check provider that is a certified FCRA-compliant CRA covers you as an employer with respect to proper collection, storage, and eventual discarding of job candidates’ personal data.

As an employer, you play a critical role in several steps of the background check process. Your responsibilities for FCRA compliance include:

FCRA-permitted purpose. The law only allows employers to conduct background checks on employees or potential hires for purposes of determining fitness for a position. Routine background checks on current employees can take place to check for recent findings since the initial report was completed (e.g., annual checks); or if an employee is being considered for promotion or is switching to a new position (e.g., one of greater financial responsibility).

Disclosure. For a background check to be legal, the employer must provide all candidates (including internal candidates) with a written disclosure of their plans to conduct the check. The disclosure document must be presented on its own—not handed over in an orientation packet or other collection of papers.

Consent. Before instructing a CRA to conduct a background check, an employer must obtain signed consent from the job candidate under review, acknowledging that the check is happening and that they give permission for it to occur.

The FCRA permits the candidate to authorize, or provide consent to, the background check within the disclosure document.

Sharing results with the candidate. Upon completion of a background check (by a certified FCRA-compliant CRA), and before making a final hiring decision, the employer must inform candidates of their rights under FCRA and offer them the opportunity to review and correct their reports. A process like GoodHire’s, which automatically provides a duplicate report to the candidate via a secure website, simplifies the process. By providing interactive tools that let candidates note questions or concerns, this approach also can reduce the amount of time required to re-check disputed information, if any.

Apply Equal Employment Opportunity Commission rules to findings review. The federal Equal Employment Opportunity Commission (EEOC) bans employers from excluding potential hires based purely on past arrests or criminal convictions, as long as state or federal regulations don’t forbid persons with criminal records from holding the job in question, and the offense isn’t relevant to performing the job.

Individuals with criminal records must be considered on a case-by-case basis, in light of job requirements and any mitigating circumstances, such as personal character, successful completion of rehabilitation or diversion programs, satisfactory job performance in a similar role, and other context. A background check CRA should provide reports that conform to those requirements. As appropriate, the CRA also should honor various states’ “ban the box” regulations, which forbid employers from asking about criminal records until after deciding whether a candidate’s qualifications merit an interview and/or serious hiring consideration.

Follow proper 2-step adverse-action procedures. If a background check leads to a decision against hiring, retaining, or promoting a candidate, the employer must issue the candidate a written notice, known as a pre-adverse action notification, and give the candidate a chance to refute or explain any findings before a hiring decision is final. GoodHire provides guidance through this process and helps generate appropriate pre-adverse action notifications to streamline this process, and provides a secure web portal the candidate can use to submit any explanations.

In instances when the background check leads to an adverse employment decision (the employer decides not to hire), employers must send a final adverse action notice to the candidate or employee.

Finalize the hire. Once all background checks are conducted; any disputed facts have been rechecked and corrected as needed; and candidates have been notified of proposed adverse actions and given a chance to respond, the employer can make a final hiring decision and notify all candidates of the final decision.

The number of lawsuits filed over alleged FCRA violations has increased steadily each year since 2010. This figure recently increased nearly 10% from 2016 to 2017, to 4,346 from 3,954.1 The volume was increasing at a similar rate (9.6%) for the first half of 2018, when the number of cases was 2,323, up from 2,119 for the same period in 2017.2

Many FCRA violation cases are class-action lawsuits, brought on behalf of sizable groups of job candidates. Widespread employer use of standardized documents and background check procedures helps make this a sound legal strategy (and a potentially lucrative one for law firms).

In organizations that make dozens (or hundreds) of hires each month, if one or more steps in the background-check process violates FCRA, it creates hundreds (or thousands) of potential plaintiffs.

Attorney Lanette Suarez noted in Law.com’s Daily Business Review, “FCRA litigation includes damages of $100 to $1,000 dollars for each individual violation and, in a class action setting, those dollar amounts can add up to multi-million dollar settlements. For example, recent class action settlements include a major transportation company that settled for $7.5 million, a major bank that settled for $12 million and a grocery chain that settled for $6.8 million.”3

A few of the highest-profile FCRA violation cases include:

Petco. In August 2018, after a two-year trial in a case that affects more than 37,000 job applicants, the pet-supply retailer agreed to pay $1.2 million to settle a class-action suit over FCRA-noncompliant background check disclosure in its online job application form.4

DISH Network. In 2016, the satellite-TV provider paid a $1.75 million class-action settlement over FCRA violations involving disclosure of its background check procedures and its procedures for sharing completed reports with applicants.5

Starbucks. The coffee giant faces a class-action suit in Georgia from a man who claims his job application was declined based on a criminal conviction wrongly attributed to him, and that Starbucks failed to give him a copy of the background check in time to correct the error.6

While coverage of FCRA violation cases typically focuses on their financial fallout, it’s important to remember that these actions also have reputational costs. No matter what their eventual outcomes may be, high profile suits and settlements bring unfavorable publicity. And the perception that an employer may be careless about job-candidate rights can discourage promising applicants from pursuing opportunities with them.

Conducting an FCRA-compliant background check is not overly complicated, but care must be taken to choose a FCRA-compliant CRA, and to ensure all necessary documents and procedures are in place from the start, and that there are no deviations. As an employer, you need to work closely with HR and legal counsel to vet all policies and procedures. Choosing GoodHire as your CRA partner will also bring plenty of guidance, support, and peace of mind.

The resources provided here are for educational purposes only and do not constitute legal advice. We advise you to consult your own counsel if you have legal questions related to your specific practices and compliance with applicable laws.

Follow Me

Jim Akin is a Connecticut-based freelance writer and editor with experience in employee relations, media relations, and social-media outreach. He has produced content and managed internal communications, business-to-business outreach, and consumer-focused campaigns for clients including Experian, VantageScore Solutions, Pitney Bowes, Medtronic, Microsoft, and Coca-Cola.

Accurate results delivered the first time means keeping qualified candidates in the pipeline, and peace of mind for you. Find out what GoodHire’s industry-leading low dispute rate means.

What does adverse action mean in hiring? Learn the steps employers must follow when taking adverse action, and the rights of job candidates who receive adverse action notices.

FCRA disclosure and FCRA authorization are required prior to conducting employment background checks. To keep your company in compliance, here’s what your FCRA forms should include.