Top 15 Best Background Check Services in 2025

Discover the best background check companies for both employers and individuals.

Resourcesarticles

Sara Korolevich

14 min read

Tax season is here, and while the filing date has been pushed to May 17, 2021 by the federal government, you’ve likely already started (or completed!) the process. Completing your own personal and/or professional tax returns and filing the appropriate forms is an important civic responsibility.

And you definitely want to trust that your current employees and future job candidates will do the same during this tax season. Filing taxes correctly and on time can show that a candidate is reliable, has respect for the law, and offers a strong foundation of executive functioning skills.

If you want to ensure that potential employees aren’t participating in tax fraud (whatever the case may be), a background check to screen for any tax liens or criminal records can help fortify your hiring practices.

Here are five things every employer needs to know about federal tax fraud and hiring processes.

From criminal tax fraud to a false tax return, what does that really even mean?

Tax fraud doesn’t always look like Al Capone and seedy crime syndicates—the average Joe can commit tax fraud, too. That’s why it’s so important for you as an employer to be on the lookout for any fraudulent activity a potential candidate may be involved in, especially for positions where the employee will have significant financial responsibilities. You may ask yourself, “If they can lie on something as important as their tax returns, what else will they lie about?”

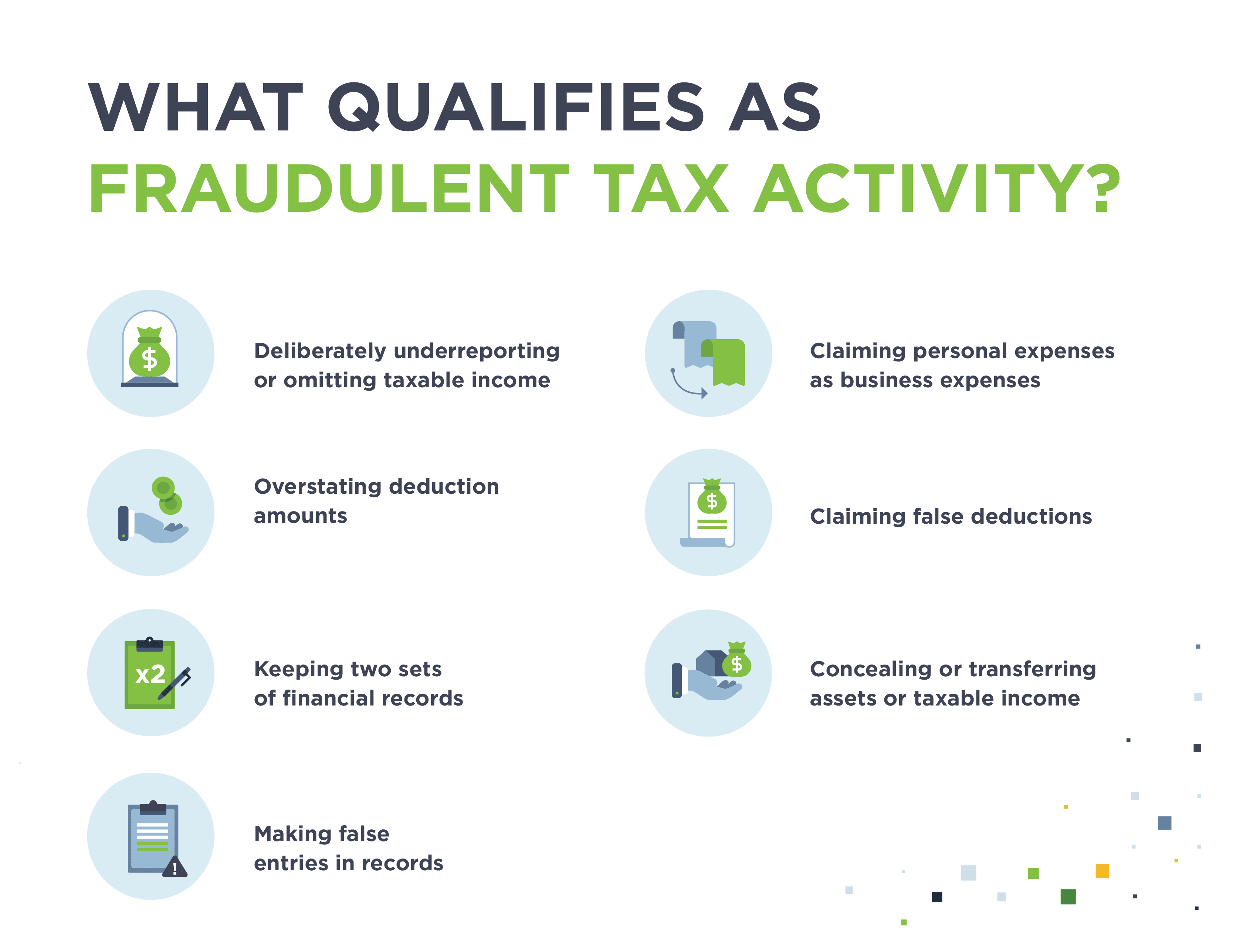

The IRS breaks down fraudulent tax activity into the following categories:

While some of these activities are certainly a clear violation, what about genuine human error? Are all mistakes considered fraud?

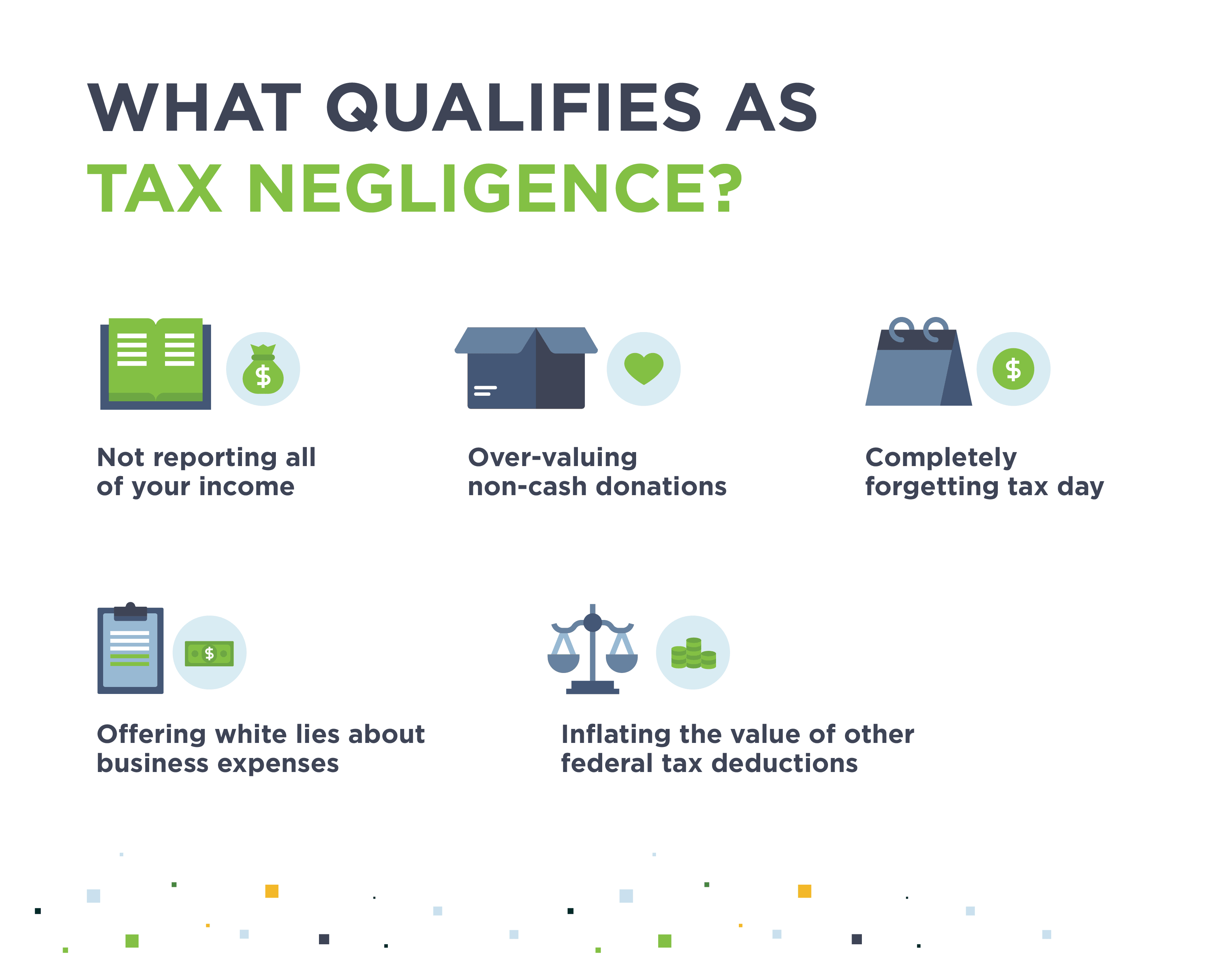

The IRS makes a distinction between tax fraud and tax negligence.

Tax negligence occurs when an individual has been careless when filing their income tax return or they didn’t keep accurate records for their taxes. Basically, incidents of tax negligence are really just incidents of tax accidents.

Taxpayers who accidentally make an error while filing taxes probably won’t face anything as severe as jail time (you’ll have to do a lot more to be the next Scarface of tax evasions!). Instead, they’ll probably have to deal with a civil penalty of about 20 percent added to their tax obligation.

The distinction between deliberate IRS tax fraud and unwitting tax fraud is important for employers to consider, as the difference can mean hiring someone who is dishonest versus someone who makes honest mistakes.

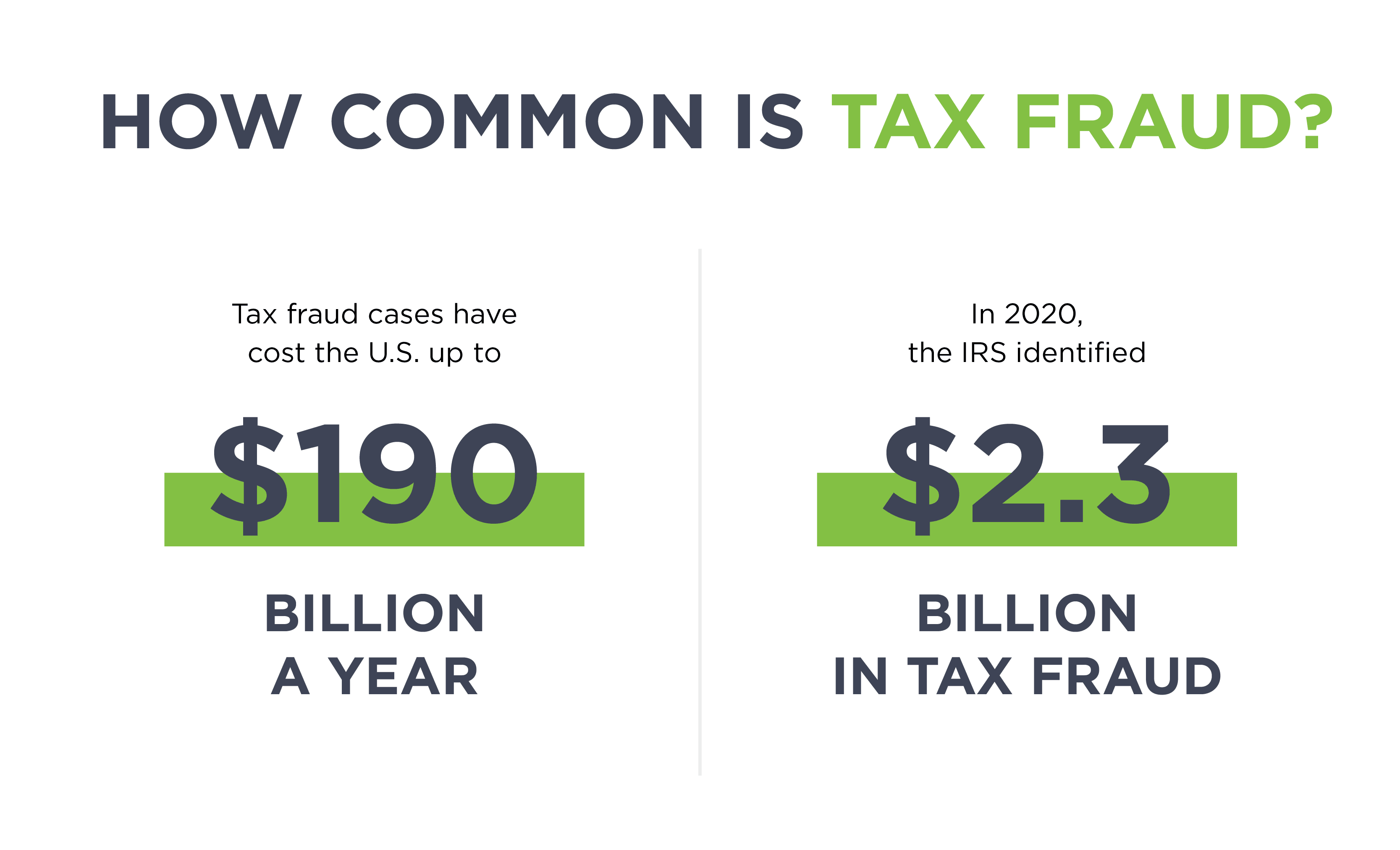

Tax fraud is a more common than you think. Tax fraud cases have cost the US up to $190 billion a year. In 2020, the IRS identified $2.3 billion in tax fraud, which included COVID-related fraud, cyber crimes, employment tax, and tax-related identity theft.

This staggering amount of money may send shockwaves down an employer’s spine. Businesses looking to hire may see these numbers and wonder, who are these people?

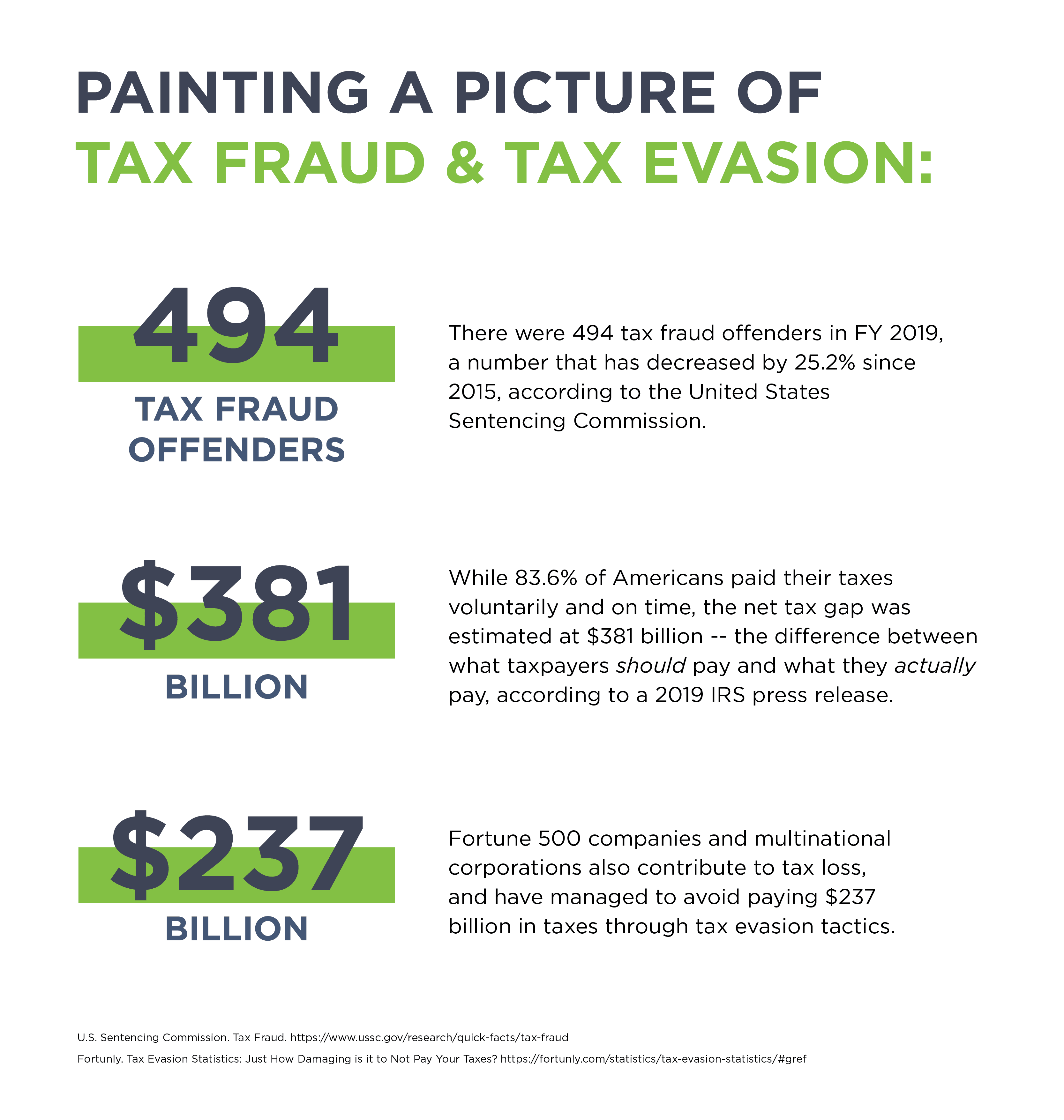

Here are some facts to help paint a clearer picture of IRS tax fraud.

So while yes, there are clearly individuals and corporations out there who are willfully misrepresenting their financial status and misfiling taxes, most citizens try to follow the rule of law.

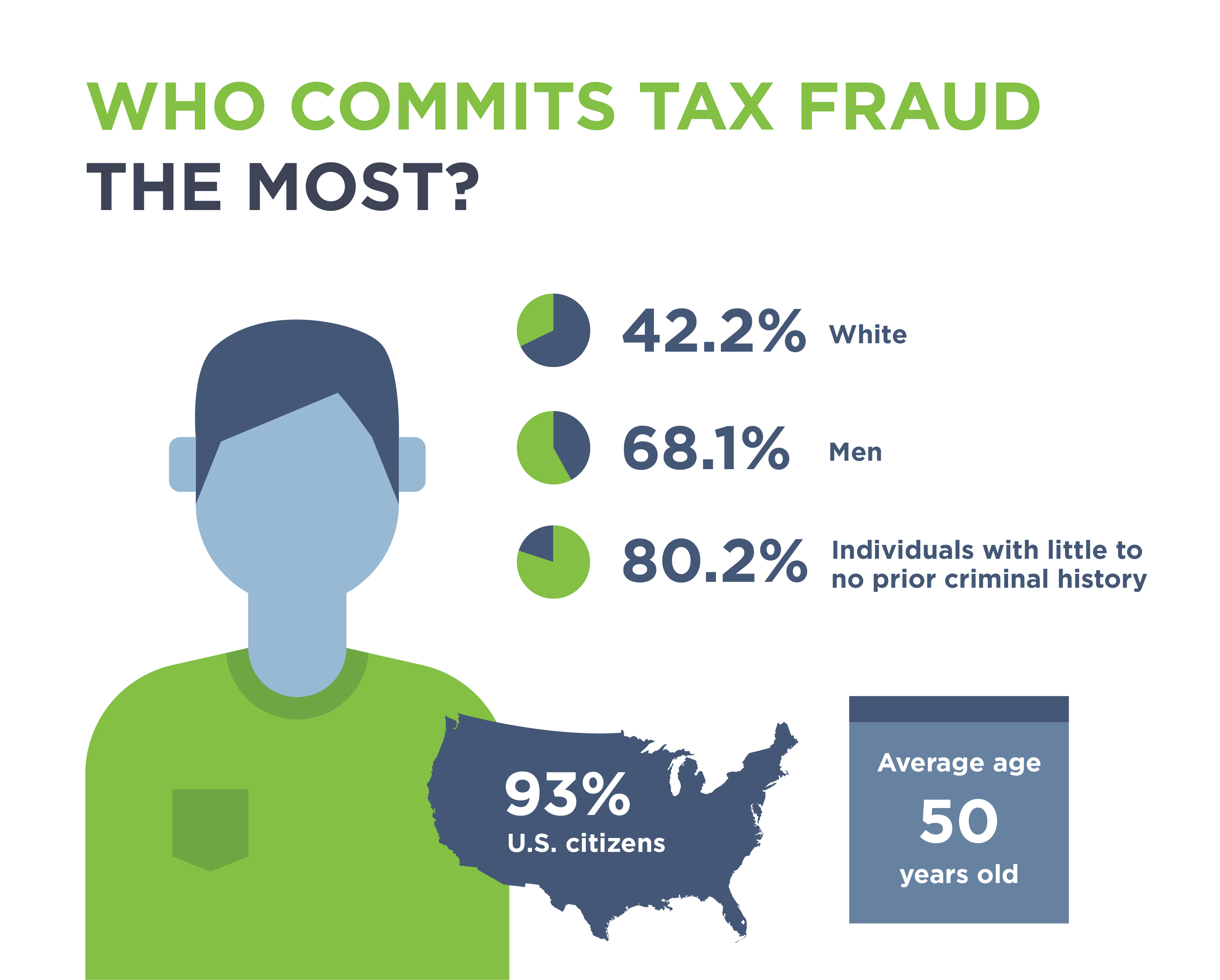

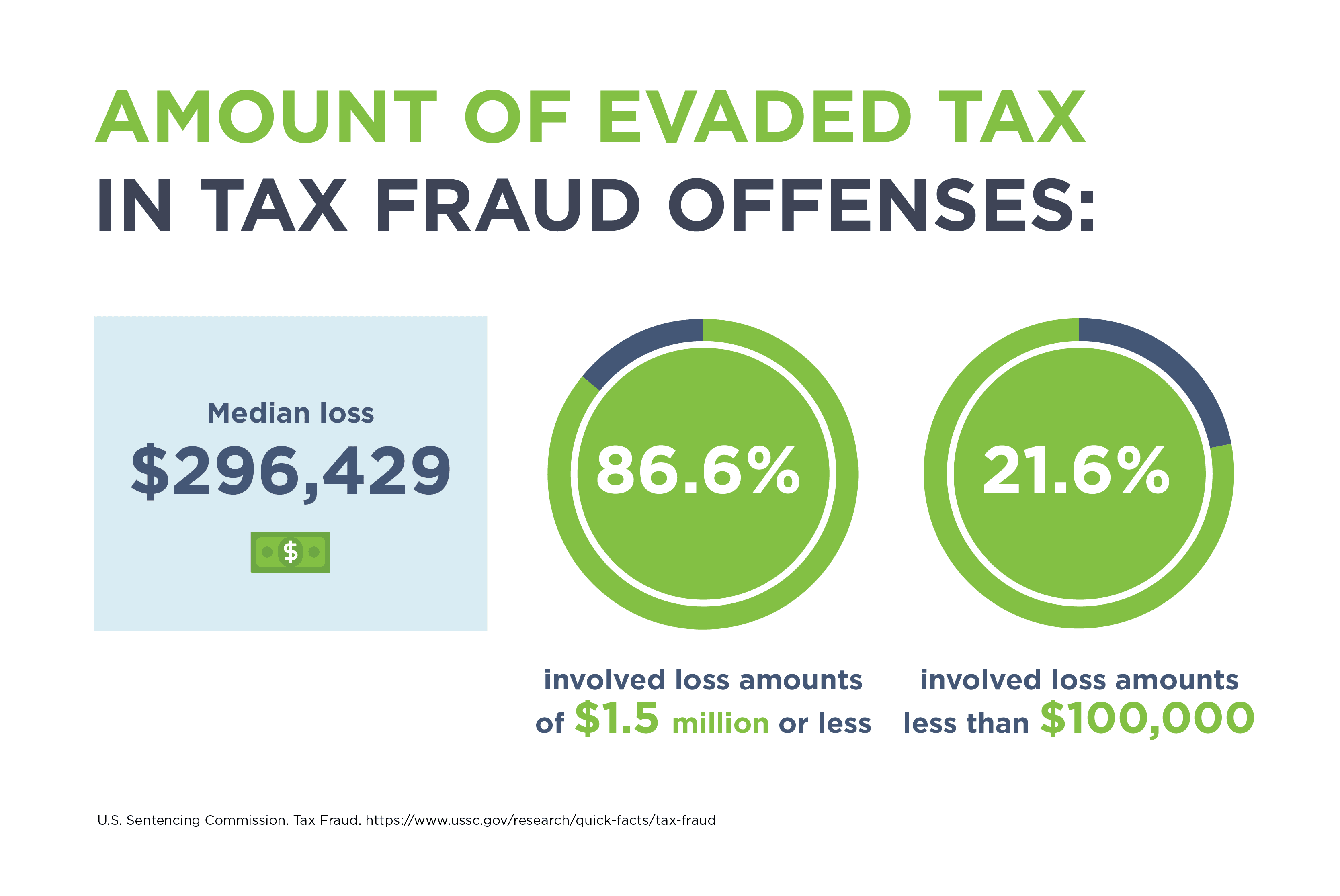

Below, we’ll outline the most common characteristics that the USSC found in its reporting on tax fraud offenders.

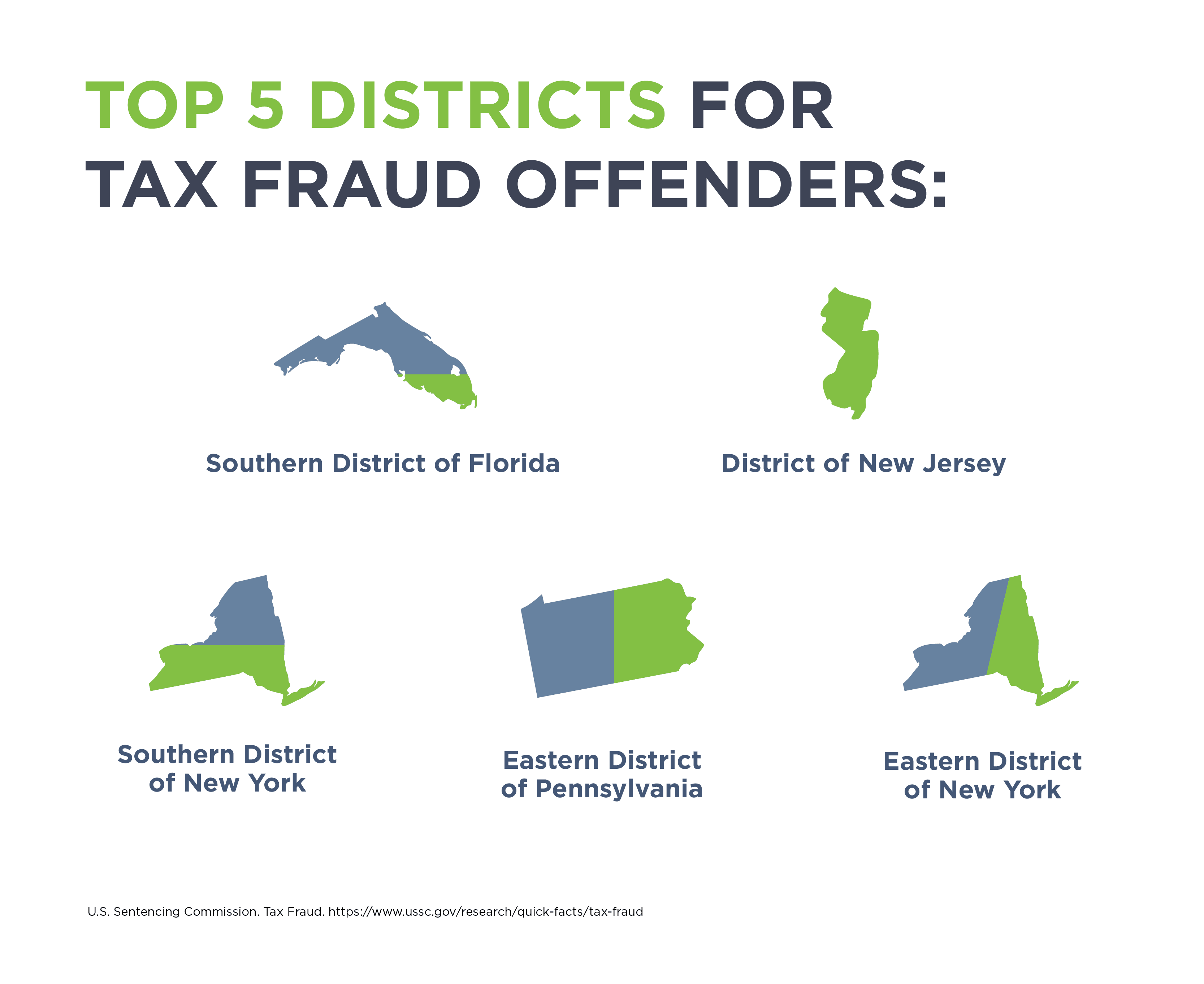

The USSC found that in the fiscal year 2019 the most common tax fraud offenders included:

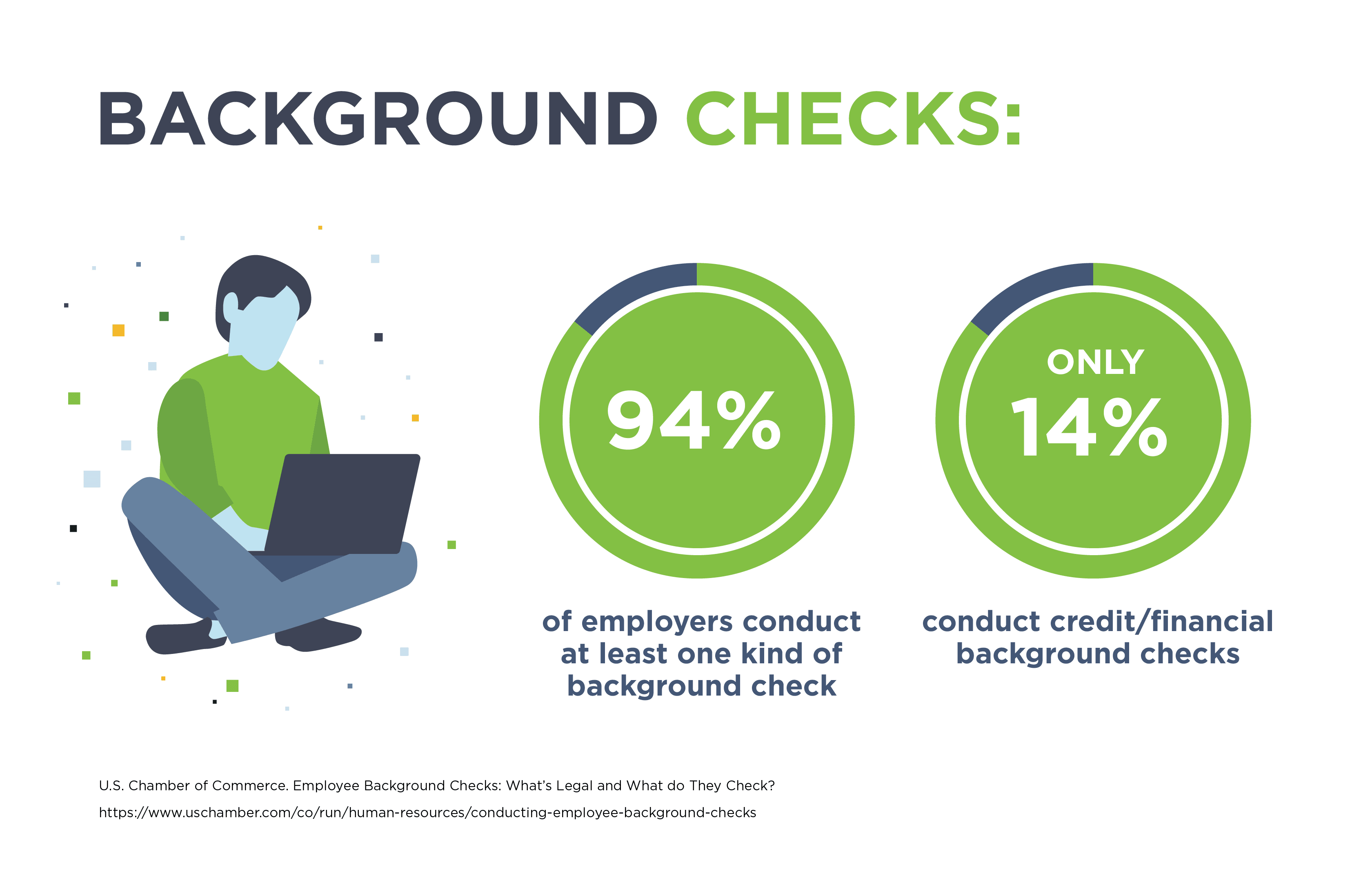

According to a 2020 survey from PBSA and HR.com, 94% of employers conduct at least one kind of background check.

Screening potential hires is a critical step when it comes to adequately staffing your business—just as some taxpayers willingly fudge the truth when filing their taxes, potential employees may generalize or fail to mention past offenses.

Investing in a reputable background check service can help you make better hiring decisions, protect your company assets, and improve workplace safety.

At GoodHire, we break down the process of verifying your candidate’s background by offering hundreds of screening services, including:

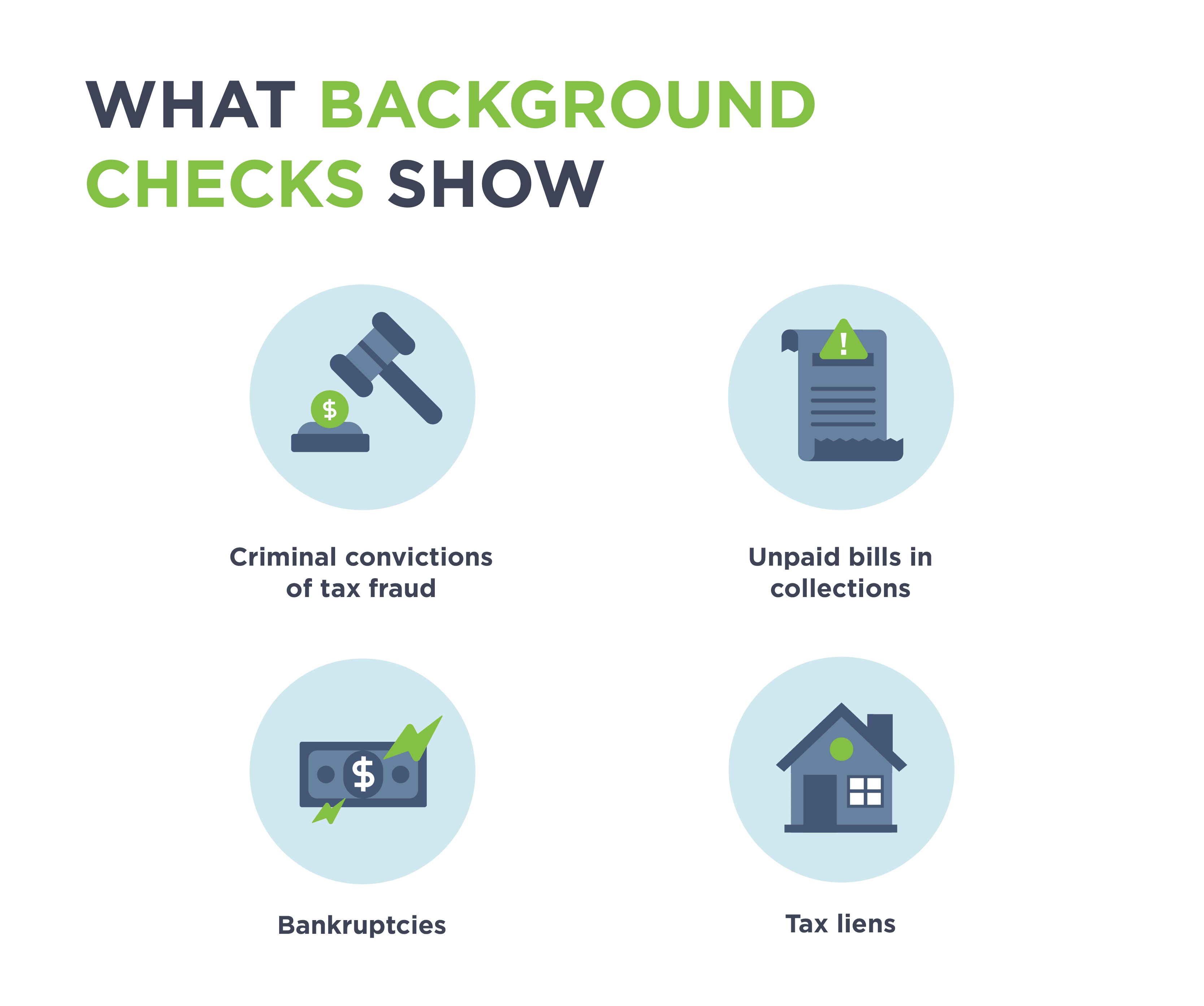

When looking for instances of tax fraud, criminal convictions will appear on a criminal background check, whereas liens, bankruptcies, and unpaid bills will show up on a civil court background check or an employment credit check.

As an employer, once you’ve discovered any red flags with a potential hire, you can then choose to investigate further, sussing out whether past financial issues are relevant to the position you’re hiring for.

Tax fraud costs the United States billions of dollars each year. The tax gap each year may be the result of tax fraud or tax negligence, an important distinction between illegal behavior and accidental errors.

As an employer, you want to make certain that everyone on your team is trustworthy and honest, especially if you are part of an industry that deals with sensitive financial matters.

With GoodHire, you can purchase background check packages that include employment background screening, credit checks, reference checks, and criminal background checks. The more you know about your current and future employees, the less likely you’ll run into problems.

The resources provided here are for educational purposes only and do not constitute legal advice. We advise you to consult your own counsel if you have legal questions related to your specific practices and compliance with applicable laws.

Follow Me

As GoodHire’s managing editor, Sara Korolevich produces educational resources for employers on a variety of employment screening topics, including compliance and screening best practices, and writes about GoodHire’s company and product news. Sara’s experience stems from 20+ years working as a B2C and B2B PR and communications professional.

Discover the best background check companies for both employers and individuals.

A “failed” a background check doesn’t necessarily mean you shouldn’t hire the candidate. Follow these five steps to make an informed decision.

Learn how to run a background check for employment to make informed, fair, and compliant hiring decisions