Credit Background Check

Credit Background Checks & Reports for Employees

A credit background check for employment is an important way to manage risk in hiring when you need a candidate with strong fiscal responsibility.

Trust & Safety

Why Credit Background Checks Matter

Reviewing your candidate’s credit history provides insight into a candidate’s integrity and responsibility toward his or her financial obligations, and are recommended for positions where access to financial assets, transactions, and decisions are a primary responsibility. Benefits of credit checks for employment include:

- Reduced risk of negligent hiring lawsuits, theft, or embezzlement

- Clear picture of a candidate’s financial responsibility

- Ability to make informed decisions based on reliable records

Results

Credit Checks For Employment: What Gets Reported

Employment credit checks show a record of a person’s credit-to-debt ratio and past bankruptcies, providing insight into how someone has managed credit and bill payments in the past—an important indicator for positions where the employee will be handling or managing money. While credit checks for employment do not report credit scores, results may include:

- Names and addresses of current and previous employers

- Notifications of bankruptcies

- A record of the individual’s credit and payment history

- Any unpaid bills turned over to a collection agency

- Other credit inquiries that have been made on the candidate

69%

of customers say they experience faster turnaround times with GoodHire. Experience it for yourself—get started.

Compliance

How Can You Stay Compliant With Credit Background Checks?

Employers must follow the federal Fair Credit Reporting Act (FCRA) when running employment credit checks, including disclosure, authorization, and consent requirements. Employers must also follow the adverse action process when deciding not to hire based on information in a credit report. Learn how GoodHire’s built-in compliance workflows can help.

State & City Laws Also Apply

Several states and a few cities like New York and Chicago have restrictions on how employers can use employment credit checks in hiring. Typically, the use of credit history is prohibited unless the employer or employee falls into special categories, such as an employee who would:

- Handle large amounts of money

- Work in a managerial capacity

- Have access to trade secrets

- Work in a field (such as financial services) in which regulations require credit reports

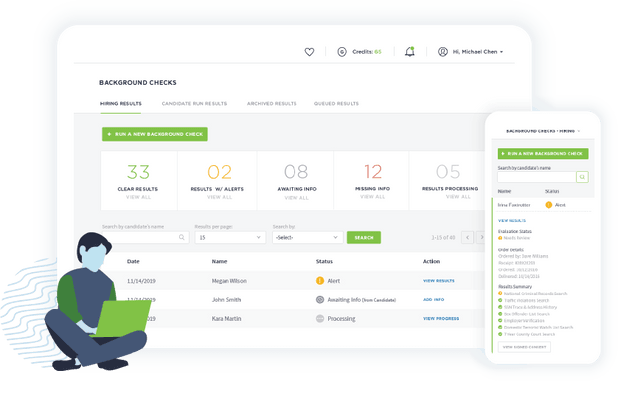

Easy to Get Started

Employers Must Be Credentialed First

Before running credit background checks for employment, employers must first meet specific eligibility requirements set forth by the FCRA. The process generally takes 3-5 days, and in some cases may require an on-site inspection to verify your business, which requires a one-time fee. GoodHire’s step-by-step workflow will take you through the process. Get started running employment credit checks in three easy steps:

Learn More About Credit Background Checks & Reports For Employees

Employers may use credit background checks as part of the background check process to gain insight into a candidate’s ability to be fiscally responsible and trustworthy. Running an employment credit report helps hiring managers make informed hiring decisions as well as mitigate potential risk for the organization. This type of check is most common for roles with access to sensitive financial information or financial responsibilities. As an employer, it’s important to ensure your credit background check process remains compliant, consistent, and fair. Let’s take a look at some common questions about credit checks for employment and how to use them in the hiring process.

What is a credit background check?

A credit background check is a type of background screening that involves looking into a candidate’s credit history, including past bankruptcies, payment history, and accounts in collections. Credit background checks for employment are most commonly used for positions that have financial responsibility and are often part of a comprehensive pre-employment background check, which may also include reviewing a candidate’s criminal history, verifying employment history, and more.

Get Fast, Accurate Credit Reports With GoodHire

Get A QuoteDoes a background check include a credit check?

A pre-employment background check may include a credit check with a credit bureau, but it depends on the specific requirements of the employer or organization conducting the process and the roles for which they’re hiring. Credit checks for employment are not a standard component of all background checks, but are often necessary for roles involving financial responsibilities or access to sensitive financial information and may be required by law in some cases.

What does a credit check show?

A credit check may show a candidate’s credit and payment history; bankruptcy notifications; record other credit inquiries made on the candidate; list of accounts in collections; and the name and addresses of both current and past employers. The results may also depend on federal, state, and local laws. A credit check for employment does not give employers access to a candidate’s credit score, bank account balances, or loan payment amounts.

How far back do pre-employment credit checks go?

Pre-employment credit checks generally go back seven years, though the lookback period may vary depending on federal, state, and city regulations. The federal Fair Credit Reporting Act (FCRA) limits the reporting of tax liens and accounts in collections to a seven-year lookback and bankruptcies to a lookback period of 10 years. If a candidate’s expected salary is $75,000 or higher or if searches are conducted by the employer themselves, these limitations may not apply.

Why do employers check credit?

Employers check credit to assess a job candidate’s financial history, integrity, and fiscal responsibility. Employers typically conduct credit background checks for employment for positions where a candidate may have responsibilities related to company financial decisions, managing large amounts of money, or accessing trade secrets.

In some cases, such as with law enforcement or roles that involve national security, like TSA agents, employers may be required by law to perform a credit background check. Certain regulated financial industries, and fiscal roles that require state or federal licensing, like mortgage brokers and stockbrokers may also mandate pre-employment credit checks.

What do employers look for in a credit check?

Employers that choose to run a credit report for employment are generally looking to learn more about how a candidate manages money. Hiring managers may use a pre-employment credit check to review an individual’s financial track record, including how they have managed credit and bill payments.

A credit background check can provide evidence of a candidate’s positive financial history, including a low debt-to-income ratio and on-time bill payments. But employers can also use the screening to look for potential indicators of irresponsible money management, such as excessive debt, late bill payments, accounts in collections, or bankruptcies.

Does an employer credit check affect credit score?

A credit check for employment does not affect a candidate’s consumer credit score. These credit checks are typically considered “soft inquiries” which do not impact an individual’s credit history. Unlike “hard inquiries”—which occur when someone applies for credit from a lender—the credit score remains unaffected by employer credit checks.

How long do credit background checks take to complete?

Pre-employment credit background checks often return results in minutes. However, before employers can order credit reports for employment purposes, the hiring organization must first meet the eligibility requirements of the FCRA. This includes an inspection and credentialing process, which typically takes 10 to 14 days to complete and requires a third-party inspection of the offices where employers plan to order and review credit reports.

Can candidates be denied a job because of bad credit?

Employers can deny candidates a job due to bad credit, particularly if the position involves financial responsibilities or access to sensitive financial information. However, federal, state, and local laws may prohibit an employer from considering a candidate’s credit history when making hiring decisions. If an employer denies a candidate a job due to the results of a credit check provided by a CRA, they are required by federal law to follow the FCRA’s adverse action process.

Get Fast, Accurate Credit Reports With GoodHire

Get A QuoteHow to run a credit background check

To run a credit background check, employers can either work with a credit bureau directly or partner with a consumer reporting agency (CRA), like GoodHire. Employers must remain compliant with the federal FCRA when conducting credit checks for employment, which includes having a permissible purpose, providing appropriate disclosure, and receiving consent from the candidate. Credit history is often prohibited unless the employer or employee qualifies under certain categories, such as working in a managerial capacity, financial responsibilities, or having access to trade secrets.

Employment credit check laws

When conducting employment credit checks, employers must be sure to remain compliant with all federal, state, and local laws. Employers that are unsure of the laws that may apply, may wish to adhere to the strictest regulations and consult legal counsel. Using a CRA, like GoodHire, can help employers understand how to run a credit check on an employee and help organizations stay compliant with hiring laws.

Employer credit check laws, and other background check laws, include:

- Credit check restrictions that help protect a candidate’s credit history from being used for employment decisions. Depending on the jurisdiction, employers may be forbidden from asking about or using credit reports unless the role falls into certain excluded categories such as management, having access to trade secrets, handling large amounts of money, or working in a field where regulations require credit reports.

- Salary history bans which are designed to help reduce discriminatory hiring practices and prohibit employers from asking about a candidate’s salary history. As more cities and states pass salary inquiry bans, or wage equity laws, employers need to be aware of new regulations so they can stay compliant.

- Bankruptcy protections that limit how far back an employer can look into a candidate’s history for federal bankruptcies. Bankruptcies do not show up on criminal or civil background checks, however employers that conduct a federal bankruptcy search can only look back seven to 10 years.

- Ban-the-Box and fair chance hiring laws that sometimes include provisions about the timing when certain types of background checks can be conducted during the hiring process, including credit checks. Often employers cannot run any type of background checks until after the first interview or conditional offer.

Employers conducting credit checks for a job must also comply with the federal FRCA. These regulations include providing the candidate with written notice of your intent to conduct a background check and receiving written consent from the candidate before proceeding. Should the result of the background check cause the employer not to proceed with the hiring process, you must follow the adverse action process.

What states ban credit checks for employment?

Currently there are 11 states and two US territories that restrict employment credit checks. These include:

- California: Employers are prohibited from using credit checks in hiring decisions, with some exceptions, including managerial roles, state Department of Justice jobs, law enforcement and peace officer positions, and certain other cases as defined by law.

- Colorado: Pre-employment credit checks are prohibited unless credit information is required by law, such as regulated financial roles, or when credit and financial responsibility is substantially related to the position.

- Connecticut: State law prohibits the use of credit checks in hiring decisions unless the report is required by law, or the employer is a financial institution. The law also allows credit checks for any job that involves access to confidential financial information or if the employer believes the employee is violating the law.

- Delaware: Credit checks are prohibited before the first candidate interview.

- District of Columbia (DC): Employers are prohibited from using credit details for employment purposes unless it is required by law, the role is for law enforcement or a financial institution, or the job requires a security clearance.

- Hawaii: State law allows employer credit checks only if it is relevant to the job, with a few exceptions, such as for positions at federally insured financial institutions.

- Illinois: Credit checks for a job are prohibited unless it is required for the role, such as if the employee has access to assets or confidential financial information.

- Maryland: Employers may request a credit check, but only after making the employment offer, notifying the candidate, and the check is related to the job.

- Nevada: Employers cannot make hiring or promotion decisions based on a credit check that the applicant has not consented to. However, the employer can request a credit check if it is related to the position, authorized by law, or if the candidate has potentially violated state or federal law.

- Oregon: State law prevents credit checks unless the candidate is notified and the report is substantially related to the job. A few exceptions to this rule include: jobs at financial institutions, law enforcement or other types of public safety officers.

- Puerto Rico: Employees cannot refuse to hire a candidate based on credit check details. Credit checks can be obtained for managerial positions, roles where a check is required by law, positions with access to financial information or access to trade secrets, or otherwise carry a fiduciary responsibility.

- Vermont: Credit checks are not permitted unless the law requires it, the position is financial or as a first responder, involves payroll access, or somehow ties to job performance.

- Washington: State law restricts credit histories unless the job or law requires it, and the employer notifies the candidate in writing.

In addition to states that ban credit checks for employment, some municipalities also restrict credit reporting.

- Chicago: City law prohibits employers from asking about credit history when making employment decisions with some exceptions, including jobs with banking, debt collection, insurance or surety companies; jobs with municipal law enforcement or investigative agencies; and jobs where a credit check is legally required or is otherwise a bona fide occupational requirement; and certain managerial positions.

- New York City: City law prohibits employers with 4 or more employees (including owners) from checking a candidate’s credit or inquiring about credit history when making employment decisions. The law applies even if employees do not all work in the same location, even if they don’t all work in New York City. However, certain types of roles are exempt, including some city police and peace officers, roles requiring a security clearance, and non-clerical positions with access to trade secrets or national security information.

- Philadelphia: City law prohibits employers from using credit information for a job candidate or employee in decisions related to hiring, firing, promotion, or discipline. Although originally passed in 2016, a 2020 amendment to the Fair Practices Ordinance added law enforcement agencies and financial institutions to those who must comply with credit-related restrictions. Some exceptions may apply.

Get a credit background check with GoodHire

Employers can use credit background checks to better understand a candidate’s ability to handle finances responsibly and with integrity. Running a credit check during the hiring process can help employers make smarter hiring decisions, mitigate potential risk, and protect valuable company assets.

GoodHire offers fast and accurate credit check services for employers. To get you started, we provide several packages that can be customized with add-on screenings for specific roles. With an easy-to-use platform, automated workflows, and built-in compliance tools, employers get a more streamlined and compliant background check process. Get started with a credit background check.

Get Fast, Accurate Credit Reports With GoodHire

Get A QuoteThe resources provided here are for educational purposes only and do not constitute legal advice. We advise you to consult your own counsel if you have legal questions related to your specific practices and compliance with applicable laws.