Background Checks

Join Thousands of Employers Who Trust GoodHire for Background Checks

See how our platform provides simply better employment screening for you and your candidates.

Top Reasons Employers

Conduct Background Checks

Background checks help you build a team you can trust, while also mitigating risk and protecting your company’s reputation. Using pre-employment background screening during your hiring process helps you:

- Make fair, informed decisions and hire qualified candidates

- Maintain a safe work environment and protect company assets

- Protect your organization against liability claims

- Comply with federal, state, local, and industry regulations

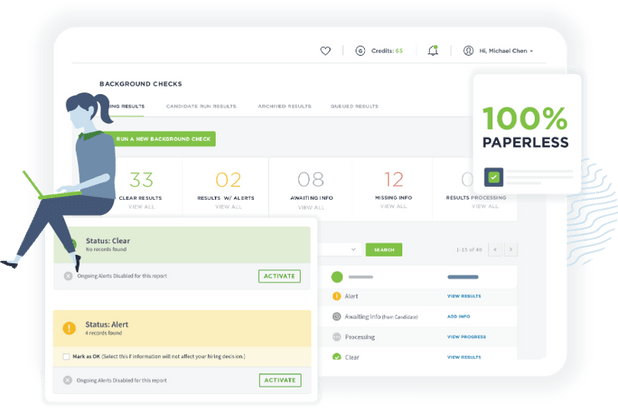

Simpler Background Checks. Trusted Results

Building a great team starts with a trusted partner that delivers the easiest end-to-end pre-employment background check workflow in the industry.

- Automated Workflows

GoodHire takes you step-by-step through an intuitive, paperless workflow - Simple To Understand

Hire faster with easy-to-review results and clear record details - Worry-Free Results

Advanced data engineering and industry-leading data sources deliver reliable results with a dispute rate of <0.1%

Employment Screening For Every Size Business & Industry In One Easy-To-Use Platform

GoodHire is easily configurable to fit the way your company recruits. Whether you’re a large company managing screening for multiple locations, or a small business needing to run a background check occasionally, we’ve got you covered.

Add checks to your workflow with pre-built integrations to leading ATS platforms.

Manage recruiting complexities across multiple locations, departments, divisions and/or clients with central control and consistent processes.

Choose from pre-built packages to save time, or design custom packages to fit specific needs.

Customers Love GoodHire. But Don’t Just Take Our Word For It.

The convenience of having all our different pre-employment services in one place just makes things so much easier. It cuts down quite a bit of time for our Human Resources Managers.

There’s flexibility there. It wasn’t like, ‘this is our program, like it or not.’ If we wanted to adjust something, we could ask the GoodHire team to throw some engineering at it and update it the way we wanted it

Explore GoodHire’s 100+ Background Checks and Screening Services

Select from our pre-bundled packages, or customize your own.

Employment Background Check Laws By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington DC

- West Virginia

- Wisconsin

- Wyoming

Frequently Asked Questions

Learn More About

Background Checks

Employers use background checks to verify a candidate’s work history, experience, qualifications, and education, and to search for past criminal activity. Pre-employment background checks help employers make informed hiring decisions and can mitigate risk to the organization, its workforce, and customers.

To make the best use of background checks, employers should prioritize developing a background check process that is consistent, legal, and fair. Here are some common questions about background checks and how to use them in the hiring process.

What is a background check?

A background check searches public records, databases, and other sources to provide information about an individual, such as a job candidate or volunteer. Pre-employment background checks are often used by employers to determine a candidate’s eligibility and qualifications for a role. In some cases, background checks may be required by law.

For instance, many states require background checks for caregiver positions that work with vulnerable populations, like children and seniors. School bus drivers are often subject to criminal history and motor vehicle record checks and rideshare drivers are typically required to undergo a background check in most states before they can transport passengers.

Certain industries also require background checks under federal, state, or local laws. For example, healthcare roles generally require robust background checks, including criminal background checks and professional license verification.

Get Faster Background Checks with GoodHire

Get StartedHow do background checks work?

Whether you’re conducting your own background check or working with a CRA, the process typically starts by verifying the candidate’s identity based on information they provide, including date of birth and Social Security number. From there, a background check for employment may involve searching public information and court records for data on a candidate’s criminal history and civil court history, driving records, and more. In addition to database checks, some searches require verification of a candidate’s employment history, educational background, or reference checks.

Employers that want to conduct their own background checks can follow some of the same processes a CRA would: verifying candidates’ identities, searching public and court records, and gathering additional information from past employers, references, public agencies (such as licensing boards), and educational institutions. Employers that go it alone may need to do additional legwork to find reliable sources, track information throughout the hiring process, and make sure to comply with all relevant laws regarding background checks.

Although employers can choose to conduct pre-employment background checks on their own, performing checks in-house can be time-consuming and strain HR resources. Employers that want to conduct employment screenings also need to understand how to do a background check (on someone) in order to stay compliant with company background policies as well as federal, state, or local hiring regulations.

Employers typically benefit from partnering with a trusted consumer reporting (CRA), like GoodHire. Working with a background check provider not only streamlines the background screening process, but often delivers more accurate results and helps support fairness and legal compliance.

What does a background check show?

A background check for employment may show a wide range of information about a candidate’s work history, education, criminal history, credit history, driving record, and more. What an employment background check shows varies depending on the type of search you choose to conduct. Here are some of the types of background checks employers commonly use in a background screening:

- Criminal background checks report a candidate’s criminal history, which may include misdemeanor and felony criminal convictions, arrest records, and pending criminal charges. Criminal record searches may return federal, state, and county records depending on the scope of the search.

- Employment verification confirms information about a candidate’s past employment, such as employer names, positions held, and employment dates.

- Education verification confirms a candidate’s academic enrollment, dates of attendance, and degrees earned.

- Professional reference checks provide a look into a candidate’s professional reputation and experience from interviews with former employers or supervisors.

- Driving record checks show a candidate’s motor vehicle records (MVRs) for driving-related information like license status, moving violations, accidents, or DUIs.

- Employment credit reports show a candidate’s credit history, including accounts in collection and bankruptcies.

- Civil court records show a candidate’s history of lawsuits, judgments, liens, and other non-criminal court records.

- Drug testing screens a candidate for the use of controlled substances, including prescription and illicit drugs.

Employers may choose different types of background checks, depending on the role. For example, employment credit checks are typically conducted when candidates apply for jobs that require handling finances; MVR checks are often critical for employees who drive on the job, especially in positions regulated by the Department of Transportation.

Get Faster Background Checks with GoodHire

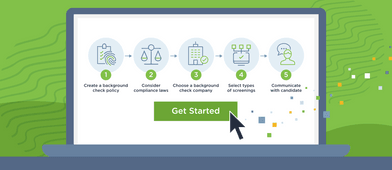

Get StartedHow to get a background check for employment

Employers can conduct their own pre-employment background checks or work with a background check services company, like GoodHire. Background checks for employment begin by consulting your organization’s background check policy, which should outline who will be subject to pre-employment screening, which background checks will be conducted, and what steps need to be taken if a background screening returns results that require further consideration.

Conducting checks internally can be time-consuming. Someone on staff, typically an HR team member, needs to conduct an online background check, search public databases and court records, and contact public agencies like the DMV or courthouses, sometimes in multiple locations. Some document requests may need to be made by mail. Checking references means reaching out to contacts and scheduling time to talk, which is itself a time challenge. Meanwhile, time is often spent on maintaining high standards for accuracy, communication with candidates, and compliance with federal, state, and local hiring laws.

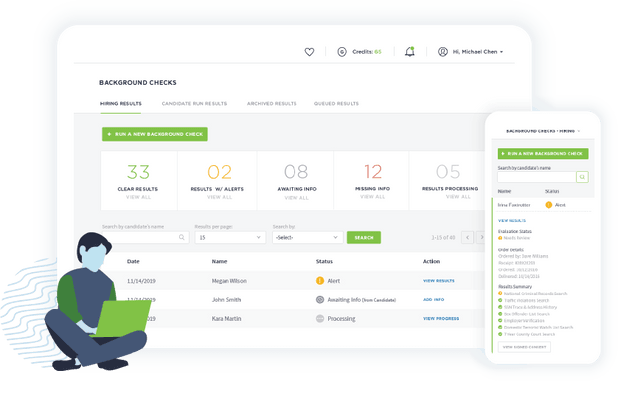

Working with a qualified CRA for a background check, like GoodHire, reduces your staff’s workload and mitigates risk for busy HR teams. GoodHire offers employers a streamlined process with increased accuracy and faster access to reports. A user-friendly dashboard keeps hiring managers—and candidates—up to speed on progress and on track with key compliance matters, such as obtaining consent and completing the adverse action process.

How to run personal background checks

If you’re wondering what to expect if a prospective employer runs a background check , you can obtain your own public records by contacting state and county courthouses in the jurisdictions where you’ve lived or may have records on file.

For faster results, you can have a background check service run a personal background report. You’ll need to provide basic personal information, like your name and Social Security number, in order for the background check provider to quickly and accurately match you with your records. Finding out what shows up on your background check allows you to anticipate questions and correct inaccuracies that may appear.

How to get a background check on yourself for employment

Sometimes employers may ask a candidate to provide background check reports, like a certified copy of a criminal history or motor vehicle record. Individuals can typically access or request certain records, like MVRs or court documents, by contacting state agencies or law enforcement. Additionally, you can often run a personal background check and download a copy of the report.

Get Faster Background Checks with GoodHire

Get StartedWhat do employers look for in a background check?

Employers use pre-employment background checks to confirm a candidate’s information and qualifications. They may look into a candidate’s criminal background, employment and education history, professional licenses, and more to learn more about a candidate’s history. Employers can choose from various background screenings to find the specific information needed to make informed hiring decisions.

An internal background check policy can help standardize the screening process while helping you comply with federal, state, and local laws. Creating a formal policy can encourage you to determine precisely what you’re looking for in a background check, so you can seek out the specific information you need and support consistent, fair hiring practices.

What can cause you to “Fail” a background check for employment?

Candidates may ”fail” a background check when the results don’t align with an employer’s background check policy requirements or other regulations, such as showing criminal convictions, a suspended driver’s license, or a positive drug test.

A “failed” background check doesn’t necessarily mean that you are disqualified from the role. While some alerts on a background check, like motor vehicle felonies, may be disqualifying for a role that requires driving, it may not be disqualifying for an office job. Some consumer reporting agencies (CRAs) offer features that enable you to provide additional context. Additionally, employers are legally required to follow the adverse action process when deciding not to hire a candidate based on the results of a background check to ensure decision making based on accurate information.

How employers can maintain compliance

Compliance is important for employers conducting pre-employment screenings as background check laws and industry regulations exist at the federal, state, and local levels. Failure to comply could result in costly penalties and even potential lawsuits. It’s important to know the laws that impact your organization based both on your location and where candidates and employees work. Where there are multiple laws in effect, employers may wish to consult with legal counsel or comply with the strictest regulations to avoid potential penalties and legal liability. Working with a trusted CRA may help: GoodHire eases the compliance burden with built-in compliance tools, saving you time and giving you confidence in your results.

Fair Credit Reporting Act (FCRA)

Employers that work with CRAs, like GoodHire, to conduct background checks for employment must comply with the FCRA. The FCRA is a federal law that requires employers to obtain written consent from candidates before conducting background checks, and to follow the adverse action process if a report contains information that may negatively impact their hiring decision, among other provisions.

Equal Employment Opportunity Commission (EEOC)

The Equal Employment Opportunity Commission offers guidance to help employers avoid using background checks in a manner that might discriminate against candidates on the basis of age, race, color, national origin, sex (including sexual orientation and gender identity), religion, and disability.

The EEOC recommends employers use the “nature-time-nature” test when assessing a candidate’s criminal history, taking into consideration the nature of the criminal offense, the time that has elapsed since the offense occurred, and the relevance of the offense to the position at hand.

Ban the Box laws

Ban the Box laws emerged in 1998, with Hawaii as the first state to pass a law prohibiting employers from asking job candidates about their criminal history until after a conditional offer of employment was made. Since then, many state and local jurisdictions have followed suit, with a focus on removing barriers that make it difficult for justice-impacted individuals to get jobs.

drug testing laws

Additional background check laws vary by state and local jurisdiction, and can be the result of wide-ranging shifts in the legal environment. For example, drug testing laws have changed with the legalization of the medical and recreational use of marijuana.

Some states have imposed regulations for pre-employment drug testing. For example, California allows drug testing only after the candidate has received an offer of employment. In other states, employers may be required to provide written notice or indicate in their job postings that drug testing is required.

fair hiring laws

Laws vary by state and at the county and city level in some cases. Here’s a snapshot of what a few fair hiring laws look like across the US.

| State | Example Hiring Regulation |

|---|---|

| California | California background check laws include CA Labor Code 432.7, which restricts employers from asking a candidate about criminal charges that didn’t result in a conviction; pretrial or post-trial diversion programs; or dismissed and sealed convictions. |

| Colorado | Colorado’s Equal Pay for Equal Work Act generally prohibits employers from asking about a candidate’s past salary information during the hiring process or using someone’s wage history to determine the role’s salary or pay rate. |

| Florida | State of Florida pre-employment background check laws don’t limit an employer’s ability to conduct searches into criminal activity, and there are no statewide Ban the Box or fair hiring laws, though some counties and cities have enacted their own. |

| Georgia | Georgia background check laws include a statewide Ban the Box law that applies to government entities of the state. It prohibits employers from inquiring into criminal history until after the initial employment application. Criminal history also can’t be used to automatically disqualify candidates (exemptions are made for sensitive positions). |

| Texas | No specific statewide Texas background check laws exist that restrict the use of criminal history when making employment decisions, but some cities and counties have enacted their own Ban the Box restrictions. |

How much does a background check cost?

The cost of a background check depends on the type of screenings ordered, the volume and frequency of reports, and who is conducting the search—an employer or CRA. While some public records searches may be free, many incur a fee per search. When performing screenings on multiple candidates, fees can add up quickly. Additionally, conducting your own background checks may have associated background check costs if your hiring manager or HR team have to devote valuable time to searching for information.

Partnering with a trusted CRA, like GoodHire, may help employers save on background check prices and overhead. With GoodHire, now a Checkr company, employers can choose from customizable and comprehensive background check packages starting at $29.99. You only pay for the checks you need, with add-ons available to meet your organizational or industry specific requirements.

How long does a background check take?

Turnaround times for background check reports typically vary based on the type of check, the scope of the search, and who is performing the screening. Some criminal record and other online database searches may return results in minutes; manual searches of county court records or checking references often take multiple days, weeks, or longer—often requiring in person visits or phone calls.

Locating the right public information sources, conducting searches, and following up where needed if often time-consuming for busy HR teams and hiring managers. Employers that choose to work with a qualified CRA, like GoodHire, can speed the process. In fact, 89% of all criminal checks complete within one hour.

How far back does a background check go?

Different background screenings can have different lookback periods. Some screenings, like education and employment verification, can look back at a lifetime of history. Other checks may be limited to only a few years by law.

The FCRA restricts how far back CRAs can report information in a background check for employment. For example, charges that do not result in a conviction, civil suits and judgments, and collections on credit reports may be reported for up to seven years. Bankruptcies may be reported for up to ten years; criminal convictions may be reported indefinitely.

State and local fair hiring laws may also limit how far back a background check can go. For example, in California, the Investigative Consumer Reporting Agency Act (ICRAA) prohibits CRAs from reporting conviction records that are more than seven years old.

Finally, some searches may be limited by the availability of records. In many states, MVRs may only report information from the previous 3-5 years. A person’s juvenile records may be sealed when they turn 18, also depending on the jurisdiction. Even unrestricted information, such as employment history, may be limited if an employer goes out of business and is no longer reachable.

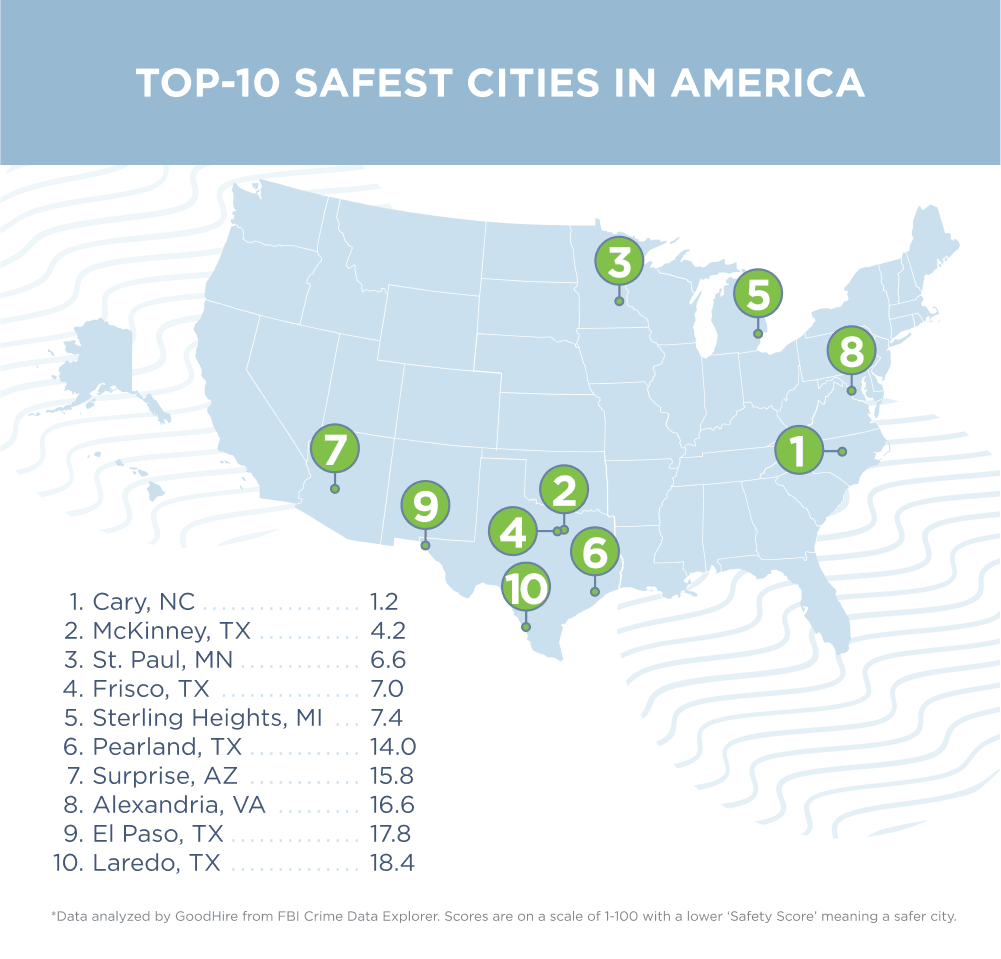

What are the safest and least safe cities in America?

To help businesses understand their importance and to reveal the cities where criminal background checks might be more useful to business owners, GoodHire analyzed the 100 largest cities by population size to uncover the safest and least safe cities in America.

To do so, GoodHire reviewed FBI Crime Data — property, violent, and society crime — and ranked each city by its rate of offenses per 1,000 people for each of the three offense types. GoodHire then assigned a total rank that weighted crimes against persons and crimes against property at 40% and crimes against society at 20%.

The final safety score is a weighted sum of the ranks for the three offense types. The safest city in America receives the lowest safety score (up to 100) and the least safe city receives the highest safety score (up to 100). View the full report.

Get a background check with GoodHire

Pre-employment background checks can help employers verify the information a candidate provides on a job application or resume, and review important facts relevant to their professional work or criminal history that may influence hiring decisions. Either way, employers need to conduct fair, accurate background checks that comply with the law.

Partnering with a trusted background check service, like GoodHire, can help. GoodHire streamlines the background check process to provide fast, accurate reports. GoodHire offers 100+ screening options, including criminal background checks, MVR checks, drug screening, reference checks, and more. Plus, our compliance tools make it easy to follow the FCRA, plus any additional restrictions that apply to local jurisdictions. Get started today.

Get Faster Background Checks with GoodHire

Get StartedThe resources provided here are for educational purposes only and do not constitute legal advice. We advise you to consult your own counsel if you have legal questions related to your specific practices and compliance with applicable laws.